- Imbalance Forecast

- Energy supply & demand

- Weather data

- Interconnector flows

- Intraday power prices

- Day ahead power forecasts

- Power price scenarios

- Balancing market data

- Hydrology

- Ancillary services data

- REMIT data

- Futures, fuels and costs

- Carbon intensity toolkit

- EU power plant database

- Hydrogen Prices

- Battery Energy Storage System (BESS) revenue leaderboard UK

- Advisory reports

- Production forecasting

- Demand forecasting

- Geolocation analysis

- Fundamental model Power 2 Sim

- Multi-Model Day Ahead Price Forecast

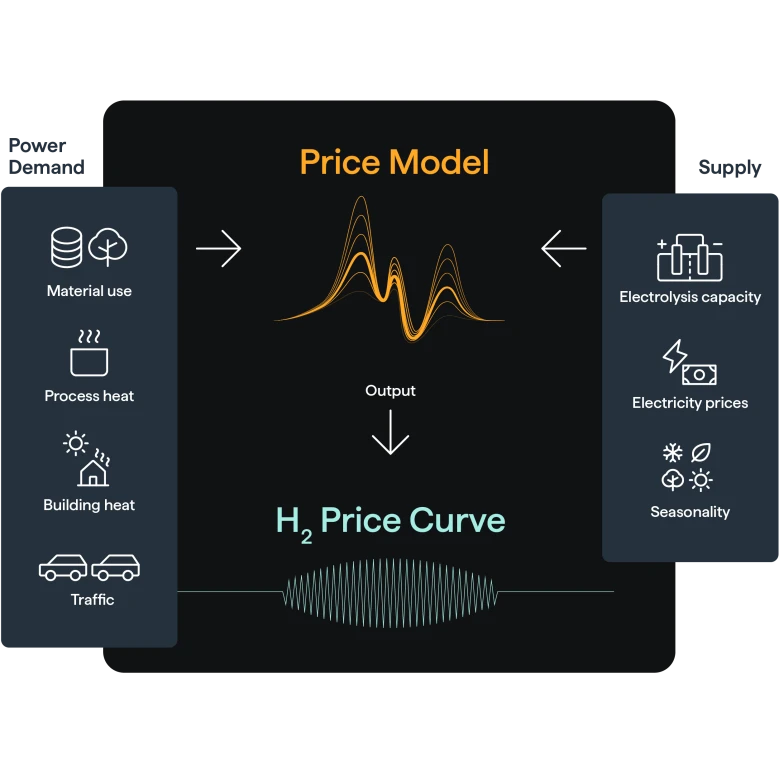

Hydrogen Prices

Get accurate insights into the future price of green hydrogen for the German market. Based on industry-leading data and scenarios.

Comprehensive data for German hydrogen prices

Use the data to analyse how green hydrogen prices will affect your energy portfolio, assess the impacts on related projects, or calculate the profitability of electrolysers and future hydrogen infrastructure investments.

Our green hydrogen pricing model predicts monthly and yearly prices out to 2050. Trustworthy projections are built on data from a range of respected sources, including:

Bankable Power Price Scenarios

Eurostat Energy Balance

Ten year network development plan (TYNDP)

Global H2 Cost Tool V3 (Institute of Energy Economics at the University of Cologne)

Hydrogen imports from Germany' (Agora Energiewende)

Our Hydrogen Prices product can be tailored to your individual market needs, providing bespoke insights for strategic planning.

Tailored for large industrial consumers, utility providers, and project developers, this tool provides insights into hydrogen’s price correlation with grey hydrogen, natural gas, and CO2 allowances. It also offers a detailed look into the potential future market structure for green hydrogen and the corresponding pricing mechanisms.

This includes comparisons to price trends in other commodities such as natural gas, oil, and grey hydrogen, enabling comprehensive market analysis.

Future-proof hydrogen pricing model

Hydrogen demand and EU Green Deal

Hydrogen price curve methodology