- Imbalance Forecast

- Energy supply & demand

- Weather data

- Interconnector flows

- Intraday power prices

- Day ahead power forecasts

- Power price scenarios

- Balancing market data

- Hydrology

- Ancillary services data

- REMIT data

- Futures, fuels and costs

- Carbon intensity toolkit

- EU power plant database

- Hydrogen Prices

- Battery Energy Storage System (BESS) revenue leaderboard UK

- Advisory reports

- Production forecasting

- Demand forecasting

- Geolocation analysis

- Fundamental model Power 2 Sim

- Multi-Model Day Ahead Price Forecast

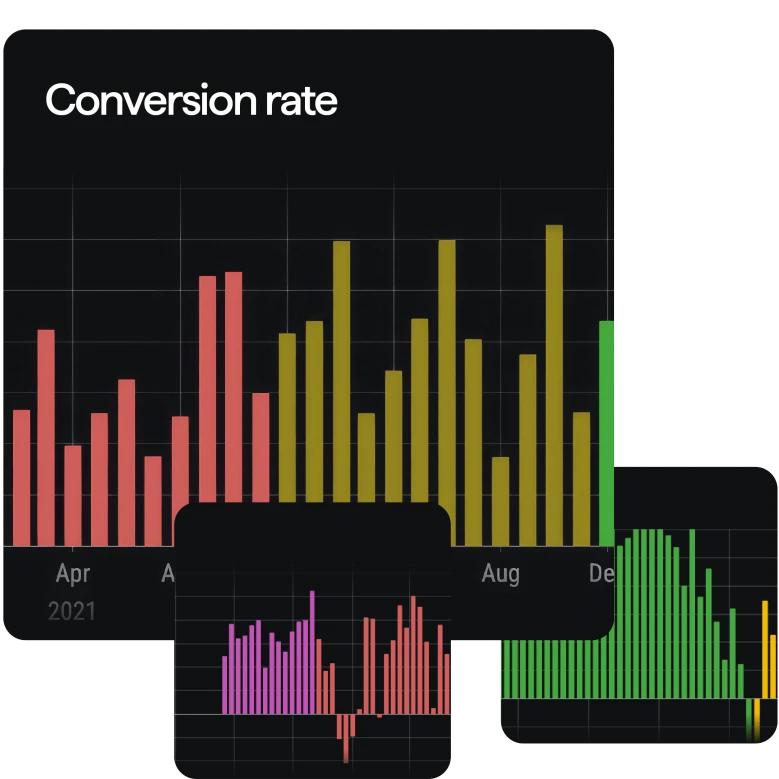

Futures, fuels & costs

Power futures, fuel prices, short-run marginal costs and spreads give you all the factors affecting closing prices for energy commodities.

Overview

Power and fuel futures presented in a standardised format alongside the associated costs and spreads. Currency conversion possibilities also make it easy for you to understand end-of-day prices including:

Power futures for 20+ countries across Europe.

Mid-December delivery contracts for European Emission Allowances.

Natural gas futures for all traded European gas hubs.

API2 futures - coal delivered into Amsterdam, Rotterdam and Antwerp.

Brent crude oil futures. The benchmark price for roughly two-thirds of the global crude oil production.

The European Central Bank (ECB) daily reference rates, based on a regular daily concertation procedure between central banks across Europe.

Commodity prices

Short-run marginal costs

Spark and dark spreads

Currency conversions

Try futures, fuels and costs for free

With so much data available, Montel Analytics often requires tailored solutions. Get in touch with our product experts so we can build the exact package to meet your needs.