- Imbalance Forecast

- Energy supply & demand

- Weather data

- Interconnector flows

- Intraday power prices

- Day ahead power forecasts

- Power price scenarios

- Balancing market data

- Hydrology

- Ancillary services data

- REMIT data

- Futures, fuels and costs

- Carbon intensity toolkit

- EU power plant database

- Hydrogen Prices

- Battery Energy Storage System (BESS) revenue leaderboard UK

- Advisory reports

- Production forecasting

- Demand forecasting

- Geolocation analysis

- Fundamental model Power 2 Sim

- Multi-Model Day Ahead Price Forecast

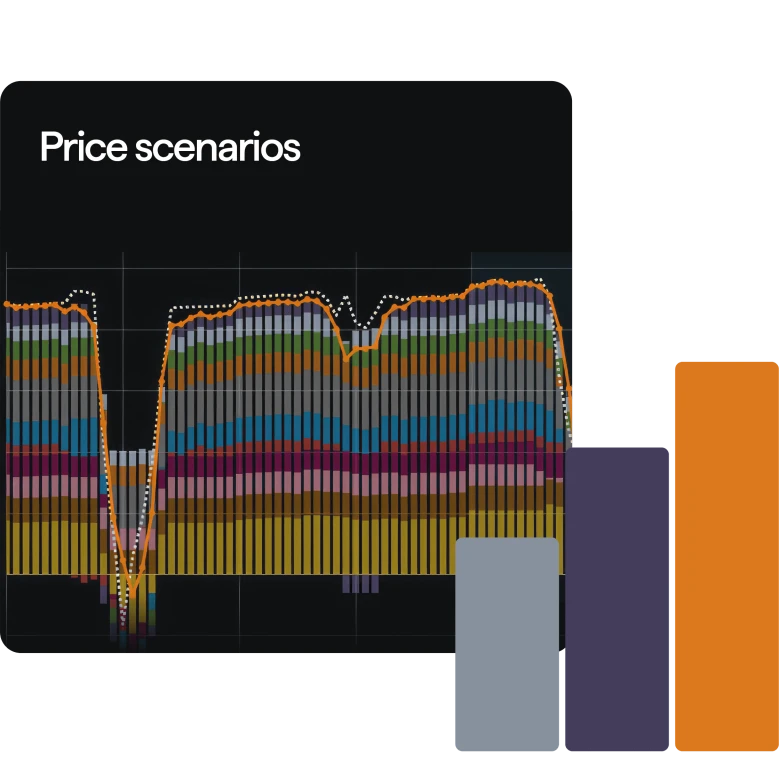

Power price scenarios

Power price simulations out to 2065 give you a clear indication of future developments.

Scenarios overview:

Whether you’re investing in hydropower, BESS, or renewable projects, our power price scenarios give you the insights you need to succeed. With decades of modelling experience across Europe and the Nordics, we provide robust, transparent, and actionable forecasts tailored to your needs.

Benefit from two complementary, bankable approaches to market modelling: systematic modelling for precise long-term planning, ideal for hydrology-driven markets like the Nordics based on the EMPS-model and fundamental scenarios based on our own energy market model, Power2Sim, for managing uncertainty across 18 European countries.

Available Scenarios:

Central Case: A baseline scenario reflecting current policy trajectories and market fundamentals.

Central-Delayed EEG Case: An adjusted case considering slower policy implementation.

Tensions: Examines a scenario of geopolitical or supply chain disruptions.

Go Hydrogen: Focuses on an accelerated hydrogen economy transition.

Stochastic-focused modelling: Evaluate the long-term impacts of weather variation in inflow, demand and renewable production on energy prices - with an approach tailored to the Nordics.

Renewable integration: Explore how wind and solar interact with hydropower-dominated grids, providing insights into future power balance changes and impacts on the power prices.

Actionable results for strategic investments: Make quantified decisions for investments in hydropower, renewable projects, or flexibility solutions like BESS or green hydrogen, backed by scenario outputs designed for the Nordic market.

Make informed decisions

Flexible data delivery with expert-led support

Explore tailored solutions

With so much data available, Montel Analytics often requires tailored solutions. Get in touch with our product experts so we can build the exact package to meet your needs.