- Imbalance Forecast

- Energy supply & demand

- Weather data

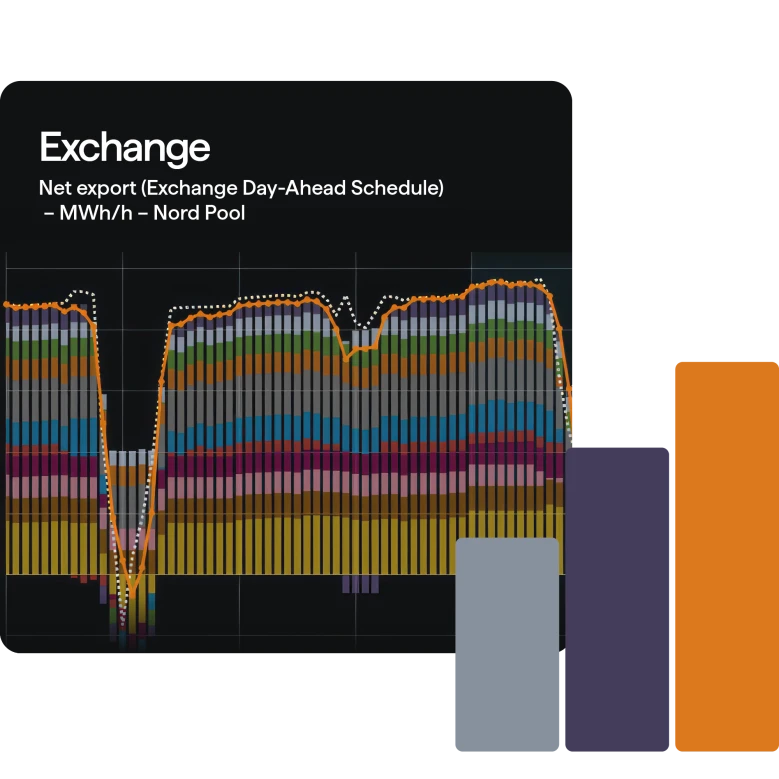

- Interconnector flows

- Intraday power prices

- Day ahead power forecasts

- Power price scenarios

- Balancing market data

- Hydrology

- Ancillary services data

- REMIT data

- Futures, fuels and costs

- Carbon intensity toolkit

- EU power plant database

- Hydrogen Prices

- Battery Energy Storage System (BESS) revenue leaderboard UK

- Advisory reports

- Production forecasting

- Demand forecasting

- Geolocation analysis

- Fundamental model Power 2 Sim

- Multi-Model Day Ahead Price Forecast

Day ahead power forecasts

Compare markets easily with expected spot prices for more than 30 European price zones.

Overview

Spot price predictions created via three different methods. Compare prognoses created by fundamental data, Artificial Intelligence and seasonality pattern analysis.

Spot price predictions created by assessing fundamental drivers from European price areas. This multi-spatial equilibrium model simultaneously predicts expected spot prices and power flows for European energy markets up 45 days ahead of time.

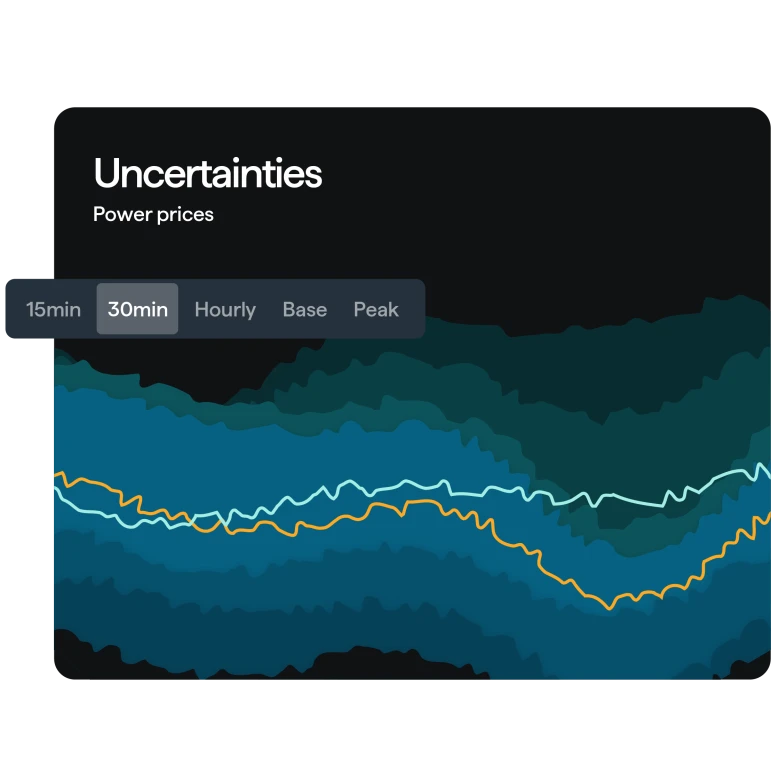

This product also includes also access to market sensitivities, such as the expected price impact of outages, as well as ensemble price forecasts which show the €/MWh impact of weather uncertainty for for your chosen price area and any neighbouring countries.

Spot price predictions created by Artificial Intelligence. Montel AI's machine learning model uses Artificial Neural Networks to learn from previous data points and improve electricity spot market forecasts over time.

Forecasts are run four times on the day before delivery at 12.40, 19.00, 09.00 and 11.00.

Spot price predictions created by analysing seasonal historical data. These spot market prognoses undergo continuous data quality assurance to give you confidence in the predicted prices.

Choose from 1-3, 1-7 or 1-14 day ahead forecasts for both the day ahead market and the quarterly ID15 auction on EPEX Spot.

Published every day at 07:00 and 13:00 CET, updates are provided in quarter-hourly resolution, delivering 96 values for each delivery day.

Market sensitivities

Ensemble forecasts

Price spreads

More than a forecast

Try day ahead power forecasts for free

With so much data available, Montel Analytics often requires tailored solutions. Get in touch with our product experts so we can build the exact package to meet your needs.