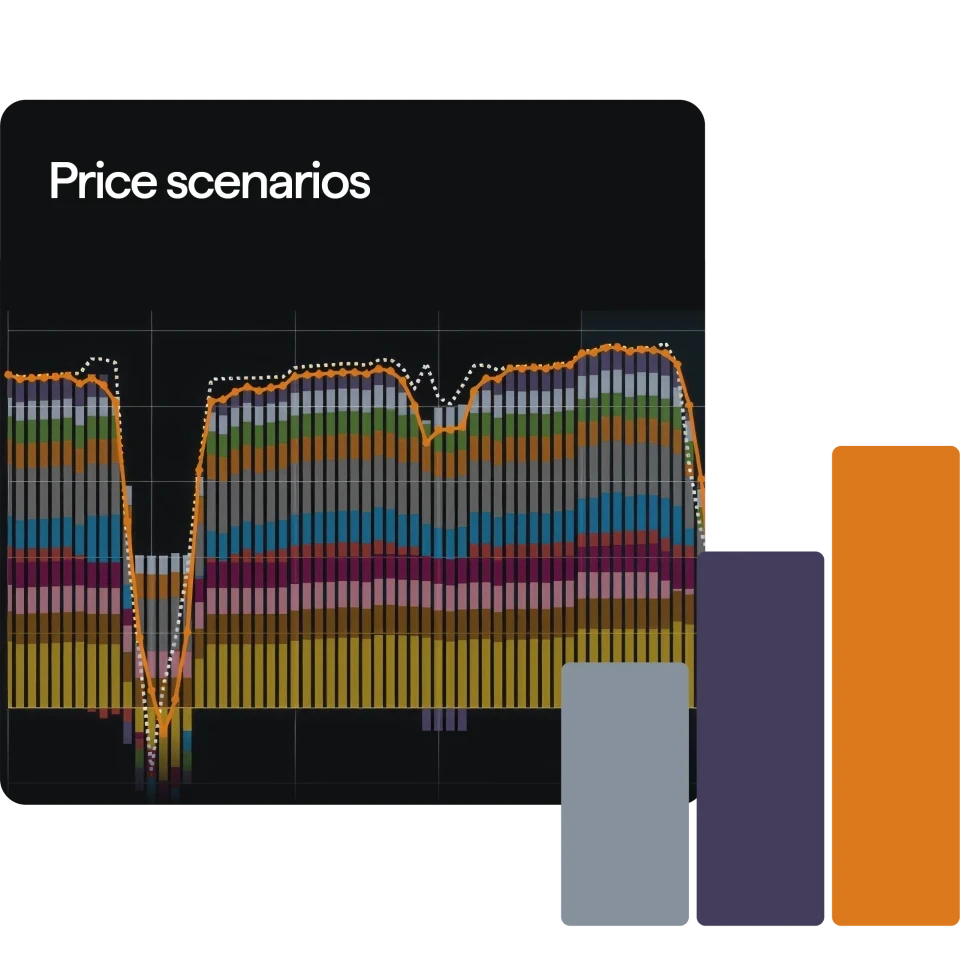

With Don Rodrigo, Baywa r.e. has realised the first purely commercial large-scale solar power plant in Europe that no longer requires any subsidies. We use the Power Price Scenarios to assess future market revenues. In our view, these are particularly accurate and are recognised by our investors and banks alike.

Dr. Benedikt Ortmann

Managing Director - Baywa R.E Solar Projects GMBH