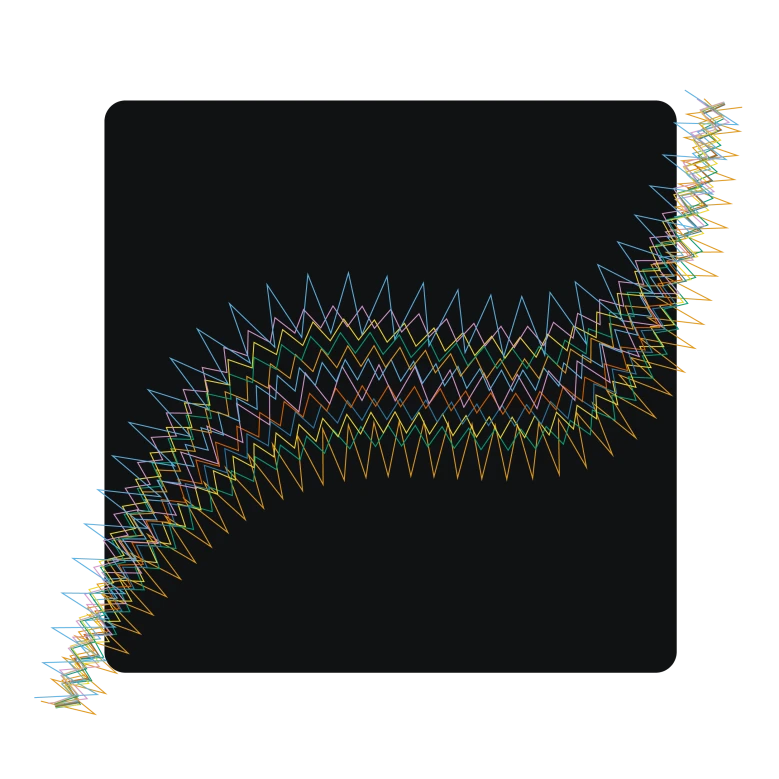

Power price scenario swarms

Simulate 1,000 scenarios to calculate portfolio risks, optimise asset production, and hedge across energy commodities.

Overview

Scenario Swarms calculate power price scenarios more than 1,000 times using our Power2Sim fundamental energy market model. Use them to interpret the probability distribution of power prices, showing you the potential revenues and risks.

With scenarios available out as far as 2065, you receive:

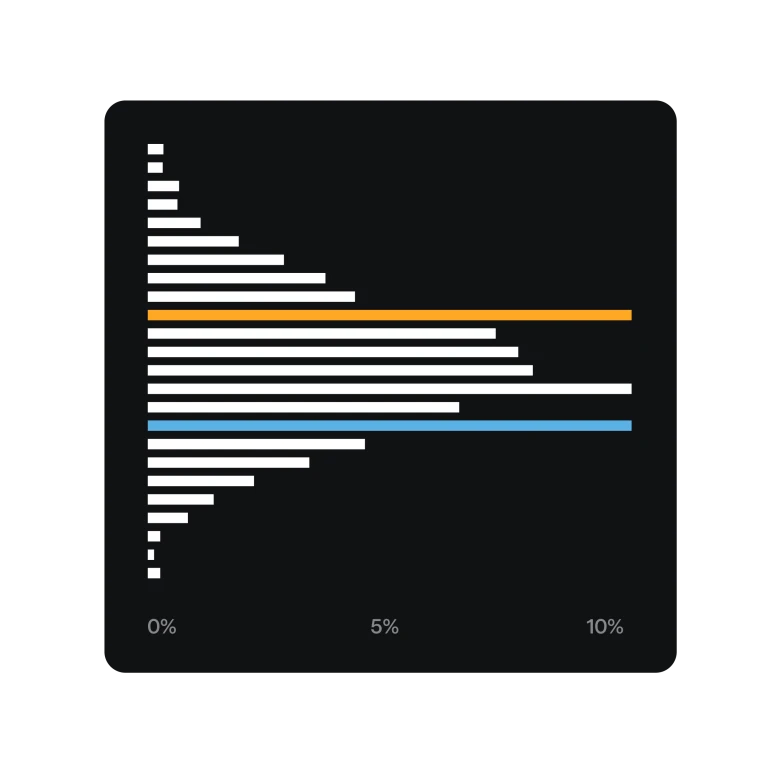

Receive probability distributions for baseload prices and capture prices in annual resolution, characterised by P-values, for example the P90 price. These key figures can refer to one year (annual P-price) or an average over several years (period P-price).

Choose from three different scenarios: Central, Tensions and GoHydrogen to form the basis for your calculations. Choose one or compare the outlook from multiple future paths.

We include follow-up time as standard to make sure you find the scenario swarms plausible and understandable.

Power price scenario Swarms

Simulate risks and opportunities across power markets

Simulate random events to strengthen your strategy

Model the impact of commodity prices, weather, and demand shocks

Build robust revenue models

Use period pricing to forecast revenue with confidence

Flexible options with expert guidance

Delivery methods

Try power price scenario swarms for free

Get in touch with our product experts so we can build the exact package to meet your needs.