The fact we can add our market expertise into the Price Forward Curves is a very big advantage as it it allows us to ensure risk-neutral market valuations. The stochastic power plant dispatch optimisation is another option that sets us apart from other providers - who mostly have a deterministic approach.

Hannes Schunke

Portfolio Manager, EVH GmbH

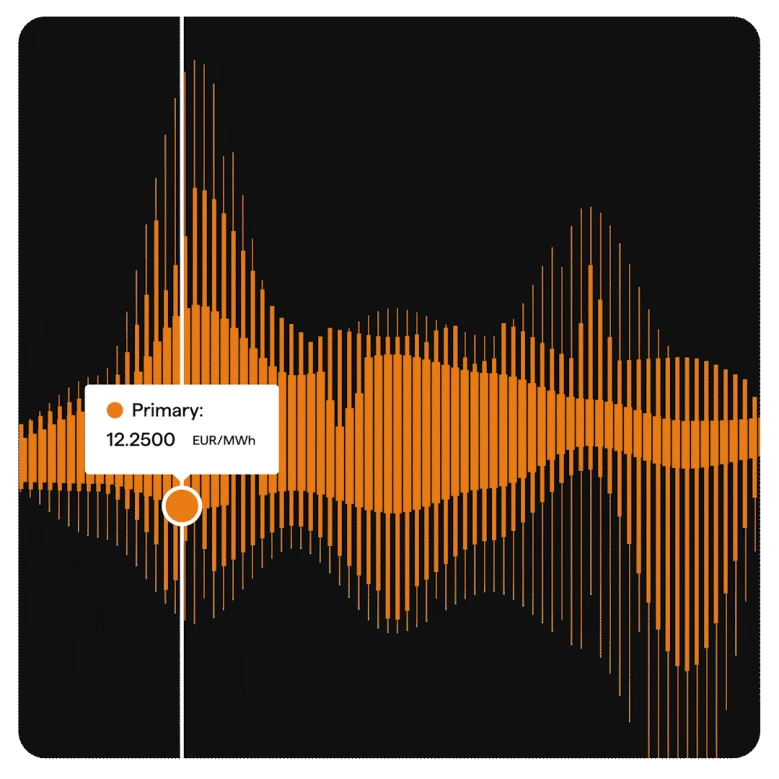

Price Forward Curves

See energy futures prices on a granular level, allowing you to assess true values and improve your trading decisions for Europe.

What is a Price Forward Curve (PFC)?

Commodities covered

Hourly or quarter-hourly resolution, covering over 20 European countries

Available in daily resolution.

Available in daily resolution.

Available in daily resolution.

Available in daily resolution.

Accurate forecasting across multiple commodities

Comprehensive market coverage with a proven methodology

Explore a range of Price Forward Curve models tailored to your needs

Our PFC models provide tailored solutions to meet the unique demands of energy commodity markets and trading strategies. From intraday pricing to cross-commodity analysis, each model is designed to offer flexibility and precision, ensuring you have the insights needed to make informed decisions in a dynamic energy landscape.

Intraday curves provide individual delivery times and price strategies for short-term trading.

Absolute Models (ABS):

Absolute Models use an additive approach with fixed spreads between hours that are not affected by changes in future price levels.

Dynamic Models (DYN):

Dynamic Models use a multiplicative, relative approach where spreads between hours are relative to the current future price levels.

Black Models primarily focus on spot prices for price forecasting.

Incorporate renewable energy sources as factors influencing spot prices.

Grey Models assume that renewable forecasts stay at current levels.

Long-term renewable energy forecasts are used to shape future spot prices.

Similar to Grey Models but anticipate growth in renewables based on governmental policies and targets.

Future spot prices are shaped by increasing contributions from renewable energy sources.

Cross-commodity Models consider renewable energy forecasts along with fundamental drivers such as fuel prices (e.g., Fuel PFCs).

XC Models use a stack/merit order model to analyze historic spot prices and forecast future prices.

Custom Models are tailored PFC models designed to meet specific custome

Fine-tune PFCs to your unique needs

Customisation options

Partner with a trusted name in market intelligence

Expert support & flexibility

Price Forward Curves (PFC): Delivery methods

Our PFCs are provided as a data service. Subscribe to have PFCs covering any cross-commodity portfolio at your disposal at any time using just a log-in.

If you're a Montel Online subscriber, you can receive the data in the application, via an API or an Excel integration feed.

Log in to the Price it platform to access the data in your personal space.

Data sent to you directly via our Secure File Transfer Protocol provider.

Make things easy with data sent to as many email addresses as you like.

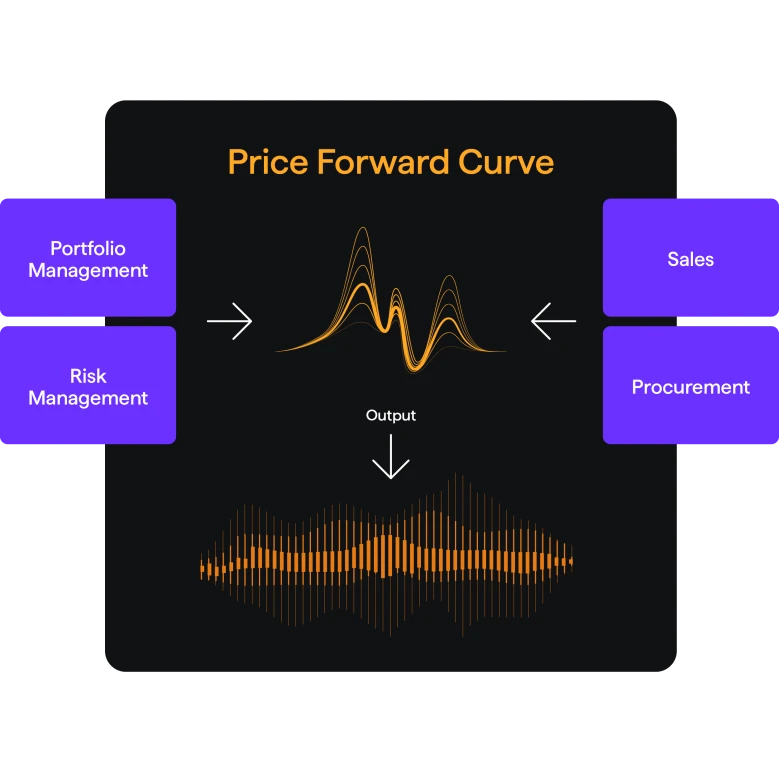

Use cases for Montel's Price Forward Curves

Montel’s forward curves are trusted by risk managers, analysts and traders across European energy markets to support critical decisions.

Typical applications include:

Do you have an hourly load profile for electricity consumption or production? With Montel’s power price forward curves (PFCs), you can calculate a volume-weighted energy forward price tailored to your actual usage. This allows you to answer:

How much is my consumption or production worth at wholesale market prices?

How would a change in market prices impact my profile value?

These insights offer a tangible view of your market exposure, crucial for budgeting, hedging, and planning. This is especially valuable in power price forecasting, where understanding your exposure to forward electricity prices in the UK or elsewhere can significantly impact financial strategy.

Portfolio managers rely on electricity forward curves to continuously monitor open positions in line with internal risk frameworks. You gain precise answers to questions such as:

What’s the current value of my portfolio?

Which contracts or zones are driving the most risk?

Where do I have unhedged exposure?

This enables you to stay compliant and in control, even amid volatile forward power price movements across regions like the UK power market.

Whether you're an energy buyer or part of a procurement team, Montel PFCs offer a credible, data-driven benchmark. Use them to:

compare supplier offers across trading zones

evaluate procurement terms in relation to energy forward prices

minimise exposure in long-term contracts by referencing electricity forward curve benchmarks

This provides a more objective and market-aligned approach to strategic procurement.

Traders and analysts across energy markets—including power, gas, and oil, utilise Montel’s price forward curves for:

power price forecasting and trend analysis

contract value comparison across borders

spotting arbitrage opportunities between forward power prices UK and continental Europe

supporting internal valuation or regulatory reporting

With accurate and granular energy forward price data, you gain a solid foundation for actionable decisions and enhanced reporting fidelity.

Try Price Forward Curves for free

Get in touch with our product experts to build a bespoke package to meet your needs.

“We can add our market expertise into the Price Forward Curves is a very big advantage.”

A valuable resource to see energy futures prices on a granular level, allowing you to assess true values and improve your trading decisions for Europe.

Montel provides us with a quick and high-quality overview of the pressing issues in energy markets. We greatly appreciate Montel’s approach and their closeness to market participants, delivering analysis as well as background information.

Ina Svenkerud Schjelderup

Head of Public and Regulatory Affairs: Nordics Benelux and Baltics, EPEX Spot