Free power: Spain tops European league table

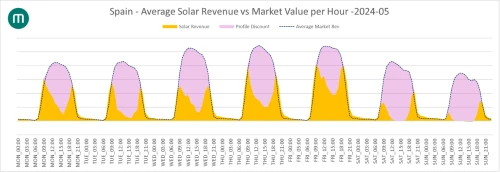

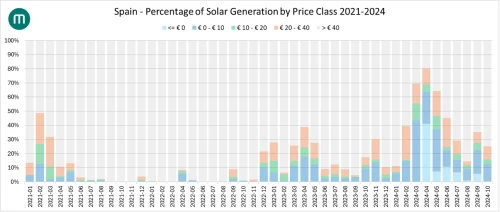

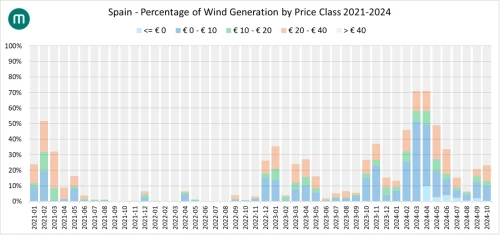

Ahead of Iberian Energy Day, Director at Montel Analytics, Jean-Paul Harreman explains how renewables are cannibalising their own revenues, with Spain and Portugal seeing the biggest negative effects on solar and wind generation.

Get the same insights as Jean-Paul