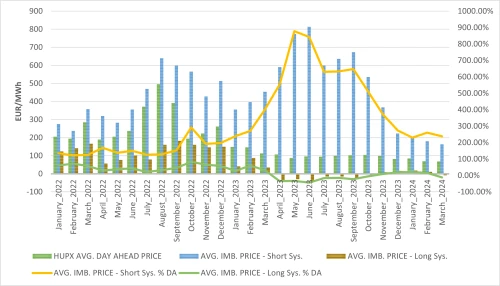

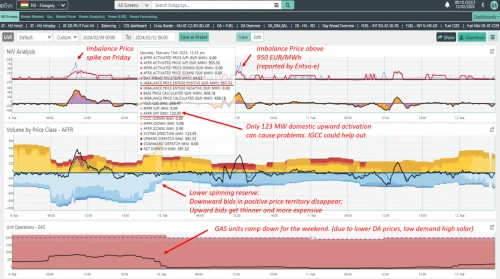

Hungarian imbalance: wrong incentives causing extreme prices

Market Expert, Gábor Szatmári explains why we are seeing an increasing amount of negative imbalance price periods in the Hungarian power market, what is driving these events and what needs to change in order to find solutions.

We have power price simulations until 2060 giving you a clear indication of future developments.

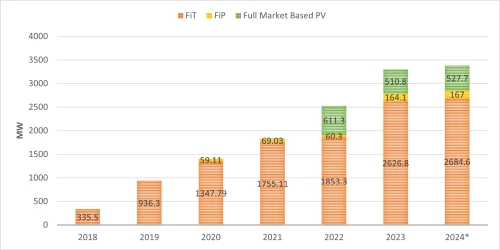

Chart 1 - HU Imbalance prices vs Balancing activations per source

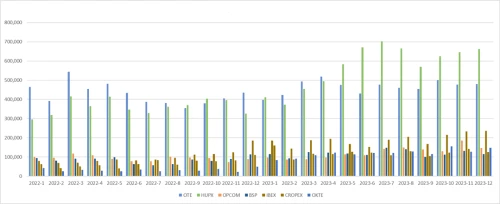

Chart 2 - aFRR available volumes by price class – makes it easier to spot expensive, more sensitive periods

Chart 3 - aggr. HU gas unit generation

Looking for European energy market data?