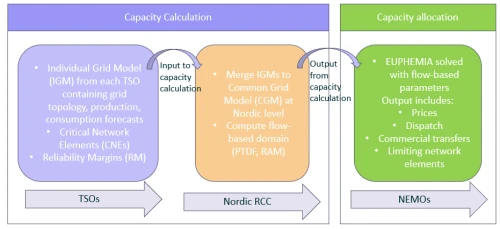

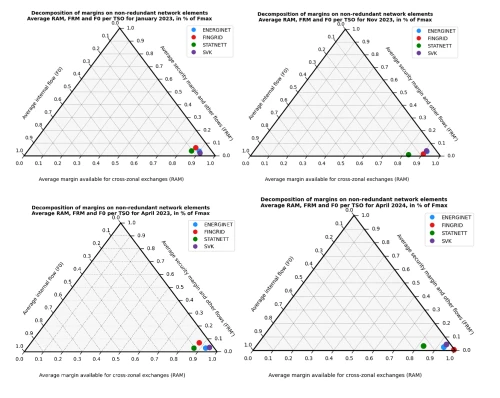

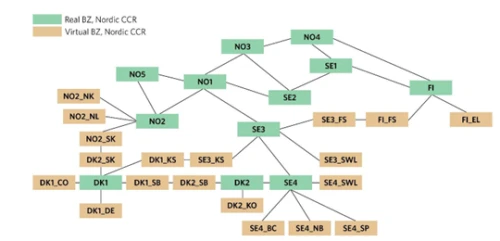

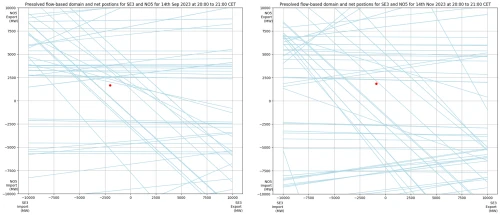

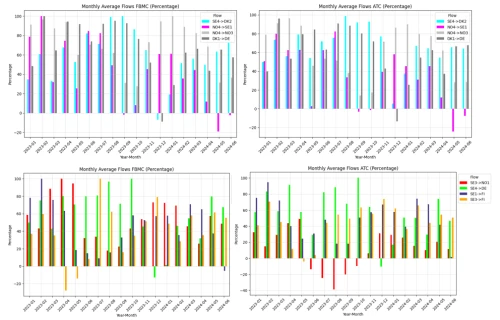

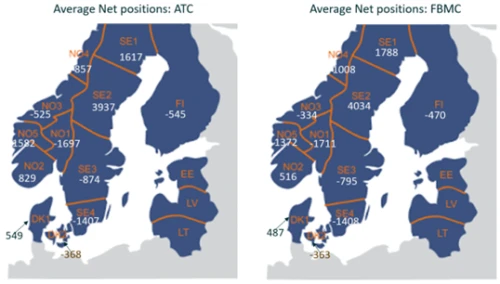

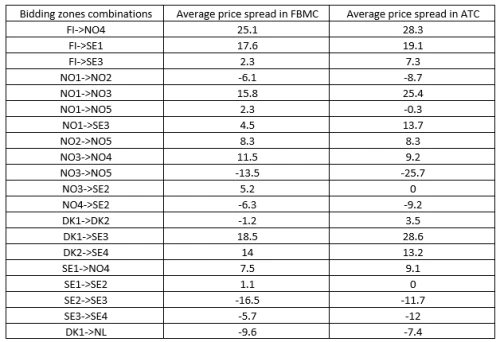

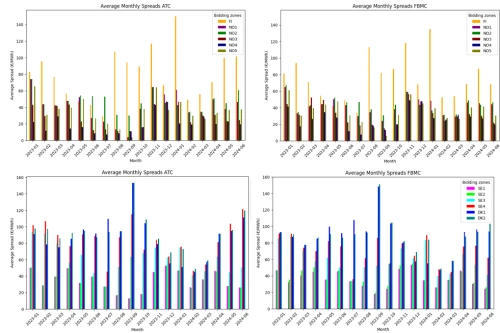

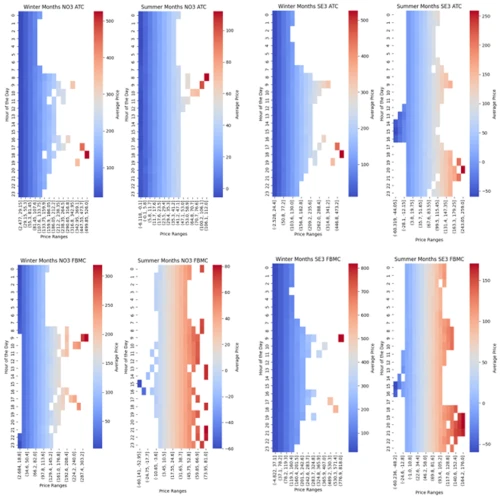

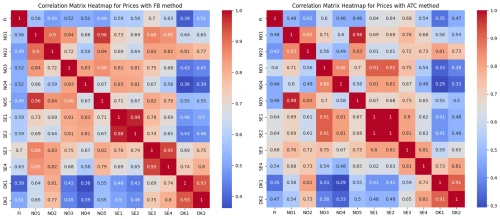

An Assessment of Flow-Based Market Coupling in the Nordics

Our Market Expert for the region, Priyanka Shinde takes an in-depth look at the advantages and drawbacks of Flow-Based Market Coupling ahead of its October 2024 implementation.

A guide to the Nordic energy sector 2024

Our expert analysis of trends, challenges, and milestones shaping the Nordic electricity market.

Follow market changes as they happen