Battery storage and its impact on German power prices: a game changer?

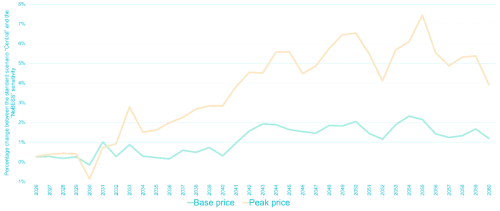

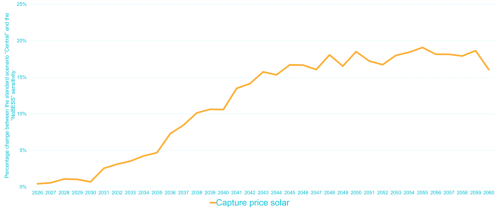

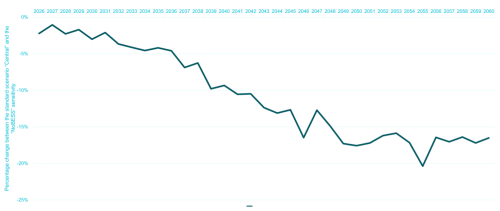

Ahead of German Energy Day 2025, Energy Analyst at Montel Analytics, Josephine Steppat takes a look at the impact battery storage systems are having on German power prices, as well as how it creates higher peak prices for solar generation.

Looking for insights into the German energy market?

Looking for more insights like these?