A new chapter for Nordic grid balancing

Priyanka Shinde, Nordic Market Expert at Montel Analytics, examines the challenges and opportunities of recent changes to the region’s balancing market, where prices recently surged to nearly EUR 5,000/MWh.

Balancing markets play a vital role in aligning supply with demand as intermittent renewable energy capacity continues to grow across Europe.

Some long-anticipated changes took effect in the Nordic balancing market at the beginning of this month. But what are these changes? Why is there so much buzz around them? What were the expectations, and how is the market coping? Let’s examine these questions one by one.

For a long time, the Nordic power system has been dominated by hydropower generation. Thanks to the flexibility hydropower provides, the system has remained well-balanced up to real-time electricity dispatch. However, in recent years, the energy mix has changed significantly. There’s more need for flexibility in the system with the increased integration of variable renewable energy sources. Additionally, demand-side participation in the markets is on the rise, creating a need to adjust the market design to accommodate new assets.

Key changes to Nordic balancing markets

1. mFRR Energy Activation Market (mFRR EAM)

The first major change relates to manual frequency restoration reserves (mFRR), which are activated to relieve automatic frequency restoration reserves (aFRR) when there is a disturbance or deviation from the nominal 50 Hz frequency. Until now, mFRR resources have been activated manually based on system needs. The transition to the mFRR Energy Activation Market (mFRR EAM) is a step towards automating this process, reducing the need for manual intervention.

2. Area-based balancing and cross-border integration

The implementation of mFRR EAM is also a step towards area-based balancing, a prerequisite for integrating with the broader European cross-border mFRR energy market, known as the Manually Activated Reserves Initiative (MARI).

3. Market resolution reduction

Another key change is the shift from a 60-minute to a 15-minute balancing market resolution. This means mFRR market clearing now occurs every 15 minutes. Many central European countries have already adopted this approach, as more granular markets enable better supply-demand matching. This benefits variable renewable energy assets, allowing them to balance their portfolios more effectively using updated forecasts. However, this transition also requires adjustments in trading behaviour. While intraday and day-ahead markets will align with this change, transmission system operators (TSOs) have stated there are no immediate plans to shift balancing capacity markets to 15-minute intervals. TSOs manage electricity grids, ensuring real-time balance and cross-border trade, while intraday and day-ahead markets allow short-term electricity trading. Balancing capacity markets, on the other hand, secures the supply of bids by paying for resources to be available at the time of balancing energy market clearing.

4. Impact of flow-based coupling

Since the launch of Nordic flow-based market coupling in October 2024, more cross-border capacity has been allocated in the day-ahead market, reducing transmission capacity available for real-time balancing. This makes local procurement of reserves more critical. To accommodate this shift, the minimum bid size has been reduced to 1 MW, and the required endurance time for providing reserves has been cut to 15 minutes.

How the Nordic balancing algorithm works

The updated market-clearing algorithm operates using conditional logic. Nordic TSOs forecast imbalances per bidding zone, generating volume requests. The activation schedule is then determined based on whether it is more cost-effective to net out imbalances across bidding zones or to perform counteractivations (upregulation in one zone and downregulation in another). These decisions depend on requested volumes and reserve prices. Shadow operation results indicate an expected increase in counteractivations and a decrease in netting.

While automating market clearing seems logical, it removes the human judgment needed to mitigate risks associated with higher volatility. The algorithm selects solutions within predefined parameters, without regard to extreme price spikes or sharp activations. This creates risky conditions for those exposed to imbalance prices. Additionally, market actors may find it challenging to operate under such conditions, leading to more complex and indivisible bids. If the algorithm excludes these bids, extreme prices could arise in certain zones, increasing the need for local flexibility and active participation with appropriately sized bids to prevent bid skipping.

Need for more data transparency

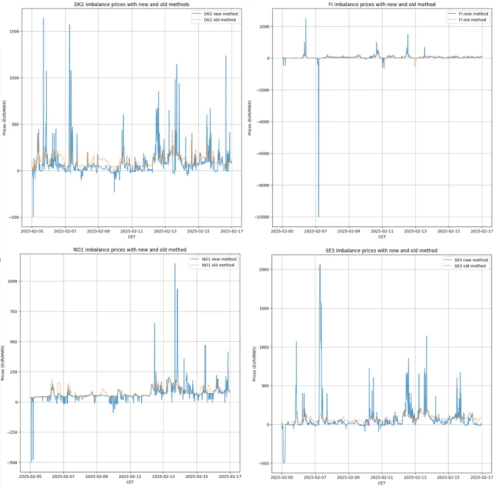

Stakeholder meetings have been held in recent months to explain these changes, but little public data has been shared regarding the shadow operation conducted by Nordic TSOs. While some price examples are available (see image below), it is important to interpret this data cautiously, as it is based on old bidding behaviour. As market design evolves, market actors will also adapt.

Following the launch of mFRR EAM in the Nordics on 4 March, imbalance prices in three Swedish bidding zones reached EUR 2,000/MWh for a couple of peak hours. In Denmark’s DK1 zone, imbalance prices surged to nearly EUR 5,000/MWh for an hour on 6 March – the highest in recent years.

Intraday markets have struggled to react effectively, as the new balancing market clearing method has made price forecasting more difficult. Moreover, there has long been information asymmetry on the imbalance prices in the Nordics due to delays in publishing the data by the TSOs. This is usually disadvantageous for smaller market participants. As the aim of this new market change is to encourage the participation also of smaller actors, it would be beneficial to create more level-playing field.

Market changes bring both opportunities and challenges. To ensure a well-functioning system, close cooperation between TSOs and market participants is essential. TSOs must improve real-time data sharing on balancing market activations to help market actors respond effectively. Enhancing transparency and market responsiveness will be crucial in avoiding extreme price spikes and ensuring a stable, well-balanced Nordic power system.

Track balancing prices in real-time

This article originally appeared as a column on montelnews.com