15 minute resolution in power markets: a success for Nordic balancing?

Priyanka Shinde, Nordic Expert at Montel Analytics, takes a look at the recent changes to the region’s balancing market – and how the system is getting a workout in pursuit of long-term strength.

“No pain, no gain.” This phrase is commonly seen at gym entrances, encouraging visitors to embrace temporary discomfort for the sake of long-term health. While it’s a familiar mantra in fitness, made famous by Jane Fonda in the 1980s, it has huge resonance for the Nordic balancing market – where strategic effort and short-term sacrifice are being observed to create a well-functioning system in the long run.

I'll be applying this mantra to an analysis of the Nordic market design updates and key results so far – including price spikes – while also focusing on the issue of data transparency. Finally, I’ll discuss the after-effects of these changes and the path forward.

The Nordic TSOs introduced a major change on 4 March with a new model to automate the clearing of the manual frequency restoration reserves (mFRR) energy market. Manual frequency restoration reserves (mFRR) are reserve power resources activated manually to restore grid frequency when imbalances occur. This coincided with a switch to 15-minute settlement times. From 19 March, imbalance prices and the balancing market began operating at 15-minute resolution. Cross-border intraday markets also now offer trading in 15-minute timeframes – a shift reflecting the growing need for flexibility and precision as the fundamentals of the power system evolve. These changes bring us closer to the ultimate goal: a fully integrated Nordic balancing market that aligns with the broader pan-European system.

The ambition is sound. A well-functioning, future-proof power system demands changes in how we operate short-term markets. But the real test is always in the execution.

Changes to Nordic Balancing Markets

The market for balancing energy – which helps keep the power system stable – used to rely on TSOs to manually choose reserve power when needed. Now, that process is done automatically by a computer algorithm run by the TSOs. The market resolution has been updated to 15 minutes, allowing for more granular clearing.

The way we set the price for energy imbalances has been changed to match how the new automatic system activates reserves. While activations in one bidding zone may support another, the imbalance price is still determined solely by the requirements within the originating zone.

Denmark and Finland are somewhat unique in this regard, as they also participate in Picasso – the aFRR energy market. The aFRR (automatic frequency restoration reserve) is a balancing service that automatically adjusts power generation or consumption to even out grid frequency within minutes. As a result, the imbalance price in these two countries reflects a combination of mFRR and aFRR energy markets.

Some key observations after these changes:

Improved frequency quality – fewer frequency deviations outside the desired range.

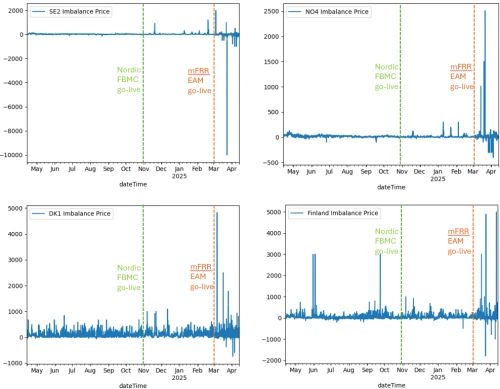

Price spikes – several extreme price events, such as EUR -10,000/MWh in Sweden’s SE2–SE4 on 23 March.

Volatility – imbalance prices have shifted rapidly, sometimes from deep negatives to high positives within minutes.

Input errors – on 9 March, incorrect capacity inputs led to a reported price of EUR -10,000/MWh in SE3, SE4 and DK2. A rerun showed the true price was EUR -500/MWh.

More local activations – tighter cross-border capacity limits have led to less reserve sharing and more reliance on local reserves.

Bid skipping – some valid bids were not cleared, often due to indivisibility issues under the new algorithm. Smaller bid sizes could help.

Delays in data – manual reviews have occasionally delayed the publication of imbalance price data.

Energy market data transparency

Understanding the new market design requires abundant data availability. This is to ensure transparency and allow participants to better anticipate outcomes. On some fronts, the TSOs have made good progress – for instance, providing area control error data per bidding zone, as well as information on scheduled and direct activations, which both feed into imbalance price calculations.

But several key data points are missing. While TSOs have noted that market participants are already adjusting their trading behaviour, the publicly available data remains limited. At present, only Finland publishes mFRR bidding curves – these are not yet available for other Nordic countries.

As mentioned above, the imbalance price is driven by the local requirement in each bidding zone rather than actual activations. Yet this vital information remains undisclosed, limiting market participants’ ability to anticipate price developments in real time.

How Traders are affected by Nordic power market changes

As the market has experienced increased volatility in imbalance prices, participants have been working to understand how it behaves. Since expectations of imbalance prices inform intraday trading, the unpredictability of imbalance settlement has made traders more cautious. Facing the possibility of high imbalance costs, some are choosing to reduce activity. While it’s still early, recent data suggests that continuous intraday trading volumes have declined, while intraday auction volumes – particularly in Norway and Sweden – are showing a slight uptick.

A key concern lies in the availability of cross-border capacity closer to real time to enable the flow of reserves. There are some ways this situation could evolve:

TSO cross-border reservation – this would require TSOs to assess the value of holding back capacity from later markets. Market participants would then need to adjust their bids. The aim is to ensure they are not worse off than if they had only taken part in the day-ahead market.

Shift towards real-time trading – as variable generation (through renewable buildout) plays a larger role in the fuel mix, trading volumes may move closer to real time rather than relying heavily on the day-ahead market, as is currently the case. This shift could become more prominent as the market better understands the recent changes, potentially easing pressure on near real-time cross-border capacities and reducing the frequency of price spikes.

Increased need for local flexibility – the price spikes also highlight a growing need for more local flexibility. Markets will need to mature at the bidding zone level, a trend that is already starting to emerge and is expected to continue.

And now, the million euro (if not billion euro) question: how much more pain must be endured before the market reaches a better place? Will these spikes persist – and what will their impact be in the short and long term?

The honest answer is that everyone is still learning. As TSOs themselves have acknowledged, this is a process of adaptation for all sides. New market designs bring their own challenges and, in the early stages, volatility is often part of the package. Whether the spikes remain or fade will depend on how quickly and effectively the market adjusts.

Remember: no pain, no gain. Or as we say in Sweden: trägen vinner. The persistent one wins.

Follow balancing markets in real-time

This article originally appeared as a column on montelnews.com