Viking Interconnector: analysing power flows and profits

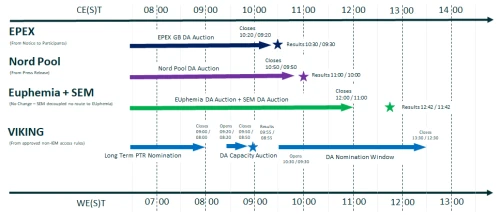

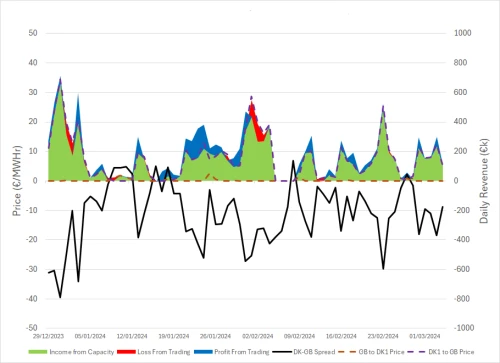

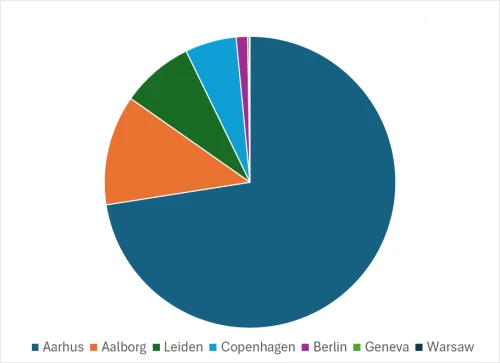

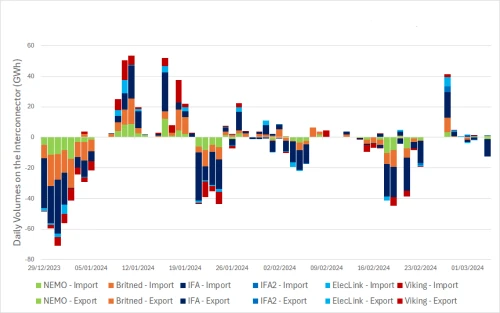

Ahead of Danish Energy Day 2024, Energy Market Expert, Phil Hewitt explains how trading processes work across the Viking Link interconnector, who has benefitted the most from it coming into operation and the impacts it has on European power market volumes.

Learn to take advantage of similar opportunities

Looking for more insights into Danish Energy Markets

Want to know more about cross-border power flows throughout Europe?