The Iberian blackout: ambition vs inertia

Jean-Paul Harreman, Director of Montel Analytics, gives his insights into last week's Iberian blackout.

The speed and scale of Spain’s renewable buildout is impressive, covering half its power generation. Just a year ago, the Spanish grid broke its own record by meeting all mainland demand from 10am to 7pm with green power. Quite the feat.

Fast forward a year and Spain is breaking records of a very different kind. Last Monday’s power outage was unprecedented – the national grid collapsed, plunging millions into darkness, disruption and disarray. How did we get here? And what does this mean for Spain’s otherwise admirable green transition?

To explain, we need to start at the beginning. In 1984, Spain built its first grid-connected photovoltaic plant near Madrid. A decade later came its first commercial wind farm in Navarra. Then, in the early 2000s, the national energy and climate plan supercharged the transition. Until last week, it had been an unqualified success.

I’ve watched and admired the speed of this progress. In particular, how rarely Spain saw negative power prices despite its high share of green generation. It was economic optimisation at its best.

Green honeymoon over

By spring 2024, however, cracks began to appear. Spain and Portugal started to see negative day-ahead prices after years of slowly declining capture prices for wind and solar. Capture prices are the average market prices generators earn when they produce power. A threshold had been crossed, and despite an intelligent subsidy design, prices could no longer be kept above zero. As 2024 wore on and into 2025, curtailment of solar and wind became a significant factor in Iberian power markets. The honeymoon for renewables – and reliable revenue – was over. This was compounded by a sluggish demand recovery after Covid and the European energy crisis.

From a technical perspective, this shift is fascinating. Suddenly, chasing a 2% improvement in fundamental weather-based forecasts – or investing heavily in alternative models – lost relevance. When renewable output is moderate, it doesn’t set the power price. But when it’s abundant, the TSO sharply limits generation. Enter constrained forecasts.

Waste or flexibility?

Renewable curtailment is often labelled as waste or oversupply, but since electricity can’t be stored like food in a fridge, it can be reasonable to limit generation when demand is low.

Spain’s “fridge” is pumped storage – but those reservoirs hit consumption limits. Power demand fell and solar generation kept rising. Solar and wind began to cannibalise their own revenue. Subsidy schemes helped cap oversupply, resulting in mildly negative or very low day-ahead prices.

Renewables developers shifted focus to other market segments, such as ancillary services.

Inertia and resilience

This brings us to a sensitive point: grid disturbances.

Wind and solar have no built-in inertia – they use inverters to convert power to the grid’s 50 Hz frequency. If something goes wrong, these inverters quickly shut off for safety, unlike spinning turbines which gradually slow down and help buffer the shock.

Island grids like Britain and Ireland must manage stability without support from neighbours, unlike mainland Europe which benefits from built-in inertia. To stay stable, Ireland caps renewable output, allowing up to 75% non-synchronous generation (power from sources like wind and solar that don’t spin in sync with the grid’s frequency).

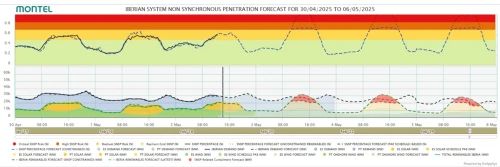

I first highlighted rising non-synchronous penetration in Iberia in a January interview with Montel News, noting that conventional generation was disproportionally low. In the months that followed, Spain’s TSO Red Electrica held non-synchronous penetration under 70% – high, but manageable in most conditions.

In the dark

In the weeks leading up to the 28 April blackout, non-synchronous generation repeatedly peaked above 70% – as on the day itself. Then, at apparently the worst possible moment, two assets in southwest Spain failed simultaneously. This rare coincidence, combined with low system inertia, triggered rapid frequency disruption and tripped the French interconnectors. While this escalated the event locally, it also helped prevent the blackout from spreading further into Europe.

Whether the disconnection with France caused the escalation or whether it was already irreversible, we may never know.

What we do know is that once frequency drops past a certain threshold, security protocols trigger automatic disconnections to prevent further damage – and this is what causes the blackout. I understand from local experts that this took a mere 20 seconds, pointing to a lack of inertia in the grid. There was simply no buffer to hold it.

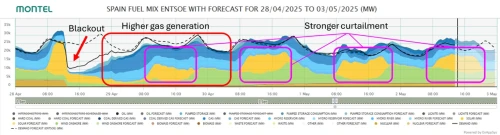

A full investigation into the sequence of events will take months. In the meantime, grid operators deserve credit for the speedy recovery. The graph below shows how gas assets stepped in to replace nuclear, providing inertia, while the TSO managed reduced non-synchronous generation. Wind and solar were curtailed slightly more than usual to allow conventional plants to stabilise the system.

Different world

This outage feels different – it happened despite grid operators' efforts and stands as the most significant incident since Italy’s 2003 blackout. We’ve seen signs of strain before – the UK’s partial outage in 2019 and the Balkans’ blackout in 2021 – but the scale of the Iberian event is in a league of its own. If we weren’t paying attention before, we certainly are now.

For power analysts, it’s a clear signal to sharpen curtailment forecasts and better reflect TSO strategies for managing non-synchronous penetration in our models, as illustrated in the graph below:

Time for new ambitions

The Spanish blackout clearly demonstrates the urgent need for grids that can cope with increasing volatility. There’s no doubt we must decarbonise our economy. However, decarbonisation and flexibility must go hand-in-hand. Australian TSOs have shown it’s entirely possible to run a stable grid with high renewables, provided the right precautions are taken.

Synthetic inertia from battery assets, grid-forming technology and synchronous condensers (spinning machines that help stabilise grid voltage and frequency without generating power) can play an important role in improving grid resilience. Many developers are looking for locations to start their projects, although barriers such as planning permissions, grid costs and low ancillary service returns have hindered progress, as well as slow-moving legislation. However, I expect this event will boost policy development. Grid operators are likely to collaborate more closely to determine what’s necessary to ensure a more resilient grid, which could result in increased frequency reserve contracting and a rise in the value of these services.

Spain’s energy future has always been driven by the ambition to lead the renewable revolution. But as we’ve seen, ambition often clashes with inertia, particularly when systems built on tradition struggle to adapt to rapid change.

I truly hope that this disastrous event boosts the energy transition by helping non-experts realise the challenges we face. If there’s one country’s energy sector that can handle this ambition, I am confident it’s Spain. Hay que luchar!

Access the data to get the same insights as Jean-Paul

This article originally appeared as a column on www.montelnews.com