Nuclear Power in Benelux, a tale of two worlds

Ahead of Benelux Energy Day 2024, Director at Montel Analytics, Jean-Paul Harreman assesses the future prospects of nuclear power in the region, as well as how this could impact the continuing roll-out of renewable energy projects.

Over the last 50 years, we have seen massive differences in Belgian and Dutch policies regarding nuclear power. Where the Belgian power system was run primarily on nuclear power for many years, the Netherlands had only two nuclear power plants supplying significant power to the grid.

Political protest has played its part in why. First there was the nationwide protests in America after the worst nuclear accident in US history at Three Mile Island in the US in 1979. This also in part lead to the closure of the Dutch Dodewaard nuclear powerplant in the 1980s. The Chernobyl disaster in 1986 then further added to the protest movement both in the Netherlands and it also had an effect on politics in Belgium.

In 1999, a phase-out plan was drawn up to remove nuclear power in Belgium. This was passed into law in 2003. Ever since, there has been speculation this plan would be reversed by a future government. This reversal did not happen, as the disaster in Fukushima pushed reconsideration further backwards. In 2012, a law was passed to start closing down nuclear plants in 2022, with the last assets to be closed in 2025.

2021 a turning point?

In 2021, under the influence of the energy crisis, a ‘plan B’ was conceived. This aims to keep 2,300 MW of nuclear power online after 2025. During the COVID pandemic, plant maintenance to the nuclear fleet in France had been so delayed that plants needed to go offline for extended periods.

Then, there were the issues with cracks in some of the nuclear facilities, causing them to be shut down for repairs as well. The uncertainty on phasing out nuclear power in Belgium also slowed down investment in new assets to replace nuclear.

In the meantime, the world had seen a paradigm shift, with solar and wind generation growing rapidly in both countries. This growth further complicated the creation of viable business cases for conventional power assets. So for example, in Belgium, sunny Sunday mornings were starting to become problematic. With low demand and a lot of solar generation, Belgium started seeing periods with much more power generation than consumption. Being a small country, obviously the surrounding countries were seeing similar weather and similar surpluses. This prompted the need for additional flexibility, to reduce power generation. Nuclear has some flexibility, but you don’t just switch a nuclear plant off, because the sun is shining, or the wind is blowing. Gas unit, that inherently have more flexibility, were not running, because they were not needed.

2024: Nuclear back on the agenda

Thanks to the recent victories of different populist parties in successive elections, nuclear power is back on the agenda in the Netherlands. Even though the country has turned into a net-exporter of power, the parties currently in government see nuclear power as an effective method to further decarbonise, arguing that wind and solar are expensive, ugly, and most importantly, not always available.

Demand increase or destruction?

As decarbonisation is expected to increase demand for electricity, additional generation capacity is needed. Especially during the evenings where solar power is unavailable or during low wind periods in winter. Just how much demand will increase by, due to increased electrification of services, remains to be seen. A lot of the additional demand is expected to come from hydrogen production.

But hydrogen development is running into many obstacles and delays, from doubts about the scalability of the technologies to the suitability of gas infrastructure for hydrogen transmission. As the molecules are much smaller than methane (and hydrogen is a strong greenhouse gas if it escapes into the atmosphere unused) more and more experts have started voicing their concerns. The economic feasibility of large-scale green hydrogen production depends on policy choices, forcing industry to shift to green hydrogen. This will only be effective if this policy is also adopted beyond Benelux.

Demand destruction has also been at the forefront of many discussions in the sector since the energy crisis of 2021. For example, some heavy industrial companies have closed sites or have decreased their footprint in the Benelux due to high power prices. There are further concerns therefore that the unilateral adoption of green hydrogen policies may force chemical and steel industries abroad. On top of that, energy efficiency has further reduced power consumption, while behind the meter solar has had a major impact too.

Nuclear power as a potential solution for decarbonisation

Does it make sense to put nuclear power back on the agenda? This is a question that many people have asked me over the years. The simple answer is that if it contributes to decarbonisation and it has a feasible business case, why would you not build nuclear power stations?

There are many countries where nuclear power makes perfect sense. When not considering environmental questions, it is a good replacement for coal fired and lignite fired power stations in countries where they make up most of the generation mix, as they run at a stable baseload level. Baseload being the key word here.

It is also important to note that there is a large difference between nuclear power stations that are active across France, Belgium, Finland, Spain, UK, Slovenia, Sweden, Hungary and the Czech Republic, and what is needed in today’s power systems.

The power/energy paradox

Assuming that we are not going to tear down wind farms, get rid of solar panels and hydro-power, then electricity will flow in ever greater amounts from these technologies. The volume of this energy is already considerable, and in many countries, this is sufficient to satisfy the demand for electricity for many hours a day. Many of these countries are now net-exporters of power too.

So, what happens if you add large scale nuclear generation? Ultimately, you lift the baseload level of power generation, resulting in more export during the solar peak and high wind periods. The problem with this is that it cannibalises revenues for renewable energy sources and pushes conventional flexible generation further out of the merit-order. As building out other flexibility takes time (and is difficult due to high grid tariffs) we see battery capacity and other flexible storage options slowly entering markets, albeit at a pace that lags far behind the growth of renewables.

The problem here, is that if storage is not an unlimited resource, power can then become a limiting factor to security-of-supply. On an annual basis, demand in the Dutch market is around 120 TWh, which corresponds with an average load of around 12.5 GW. If you combine the energy produced by solar, wind and potential new nuclear, it may add up to the correct amount of TWh, but the grid has to be in perfect balance all the time. Something which is increasingly proving difficult across Europe.

If we purely look at the demand, this varies between 8 GW and 18 GW roughly. With peak solar generation well above 15 GW, and a maximum export capacity of around 8 GW, this already leads to issues.

Adding several GW of baseload nuclear generation would result in power generation exceeding these boundaries. One would assume that solar and wind would then get curtailed to keep the grid in balance. However, it is not always that simple as a very large share of solar generation is installed ‘behind the meter’. This means it is installed for businesses and on the rooftops of individuals homes - who do not switch them off, even if they know how to do it. This remains a significant question for the Dutch regulator and TSO to consider.

Value of renewables, gone with the wind?

With additional power from new nuclear plants, the solar peak would see more a bigger excess of power, resulting in more negative prices (both in number of instances and severity). With the end of the ‘net-metering’ benefit (from January 2027), this would provide a 'double punishment' for solar panel owners. Not only will they lose the benefit of netting their solar generation versus consumption on an annual basis, but the value of their solar power will be further hollowed out.

Wind power is slightly less affected. As it can be ‘dispatched’ more easily, it will just see a further cannibalisation of revenues if this baseload generation is added.

With the additional baseload, there will be less room for conventional power generation too. Gas and coal plants are likely to see lower running hours, apart from assets that are contracted for ancillary services. These assets can cover the ‘lost money’ from lower market prices, by increasing the availability fee for providing reserves to the TSO.

With even lower levels of spinning reserves, flexibility on running power stations, the balancing risk for both renewables and consumers goes up. The scarcity effect of low contracted reserve capacity can be seen in Belgium, where balancing prices see very negative values for periods of surplus generation and where the imbalance price can rise sharply at times of shortage.

The business case for nuclear

So, does this mean that there is no future for nuclear power in Netherlands and Belgium? I would not go that far, as there are scenarios in which nuclear power can provide additional system stability, inertia and even flexibility to the grid.

If demand for electricity goes up massively and we keep large industries in Europe, having additional baseload generation will be very useful. The price of ‘green’ hydrogen should cover the cost of running the plant.

The other scenario in which increased levels of new nuclear works, is where massively flexible nuclear power is added. Anything that can take over the role of gas-fired generation can basically run in a power grid that sees a large volume of renewables. However, we have not seen any Small Modular Reactors (SMR’s) operational in Europe until now - the only units in operation are in Russia and China.

Working on current assumptions, building two large nuclear power plants without any certainty of the expected demand increase is a risky gamble. If demand doesn’t arrive then power prices will drop, especially for renewable assets, but also for the nuclear assets themselves.

Although nuclear power is relatively cheap to produce, recent nuclear plants have negotiated a minimum power price of over EUR 90/MWh (Hinkley Point GB: GBP 89.50). Even where strike prices have not been secured in Contract for Difference auctions, potential nuclear investors have argued that at current power prices, they cannot operate profitably.

Finland’s power market is an example of what happens when demand does not increase as expected. After being expected to commission in 2009, the Olkiluoto 3 plant finally went live in 2021, causing Finnish power prices to plummet. In 2023 and 2024, Finland then became the country with the largest number of negative power price periods in Europe. To create a viable business case, adding large nuclear assets would very likely require subsidies or guaranteed feed-in tariffs, similar to that at Hinkley Point in the UK.

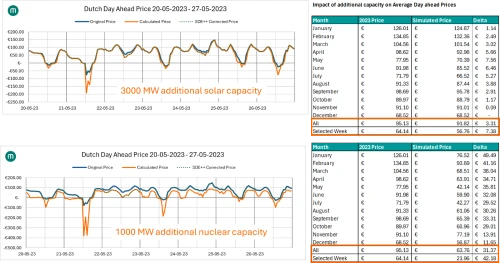

The example below demonstrates the impact of additional baseload. Comparing the impact of 3000 MW of additional solar capacity to a historic week in 2023, alongside an additional 1000 MW of nuclear capacity. Interestingly, the impact on average prices is much higher when we install only a third of the nuclear capacity (to compensate for lower run hours of solar). On an annual basis, the captured value is nearly EUR 30 lower per MWh of produced electricity.

Constructing a feasible business case for nuclear power is likely possible, but we will need a much more nuanced discussion going forward. Much will depend on the choice of technology and the application of electricity produced in the future, as well as the growth of renewable generation and the need for flexibility.

What’s clear is the playing field is continuously changing. What made sense in 2004 (net metering rule to promote investment in solar-pv) may not be so sensible now.

What we think about today’s decisions in 2035, one can only guess. Personally, I would like to see politicians trying to understand a little more about the logic behind ‘good’ and ‘bad’, especially in an area as complex as energy and climate change. Thankfully, we at Montel are here to help.

Looking for data and insights like these?