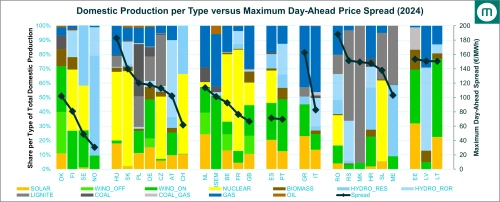

Negative price season is here, are batteries ready?

Andre Bosschaart, Head of Analytics at Montel Analytics, examines European countries to identify the most attractive business cases for batteries, highlighting the impact of solar, gas, and price volatility.

Get more information on revenue opportunities for Battery Energy Storage Systems