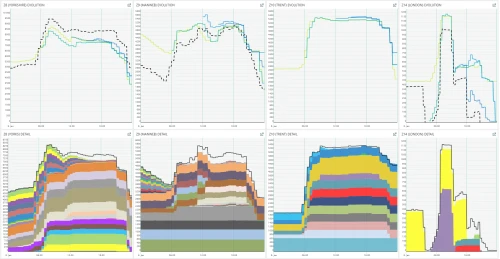

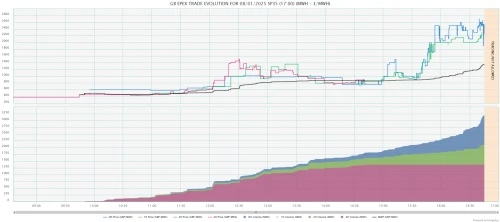

Lessons from the recent GB market crunch

Phil Hewitt, Director at Montel Analytics, looks at how the GB power market handles stress by giving an hour-by-hour account of a recent power crunch on 8 January. With all available tools deployed to keep the lights on, some producers saw significant profits in the balancing market.

Get the same insights as Phil into European energy markets