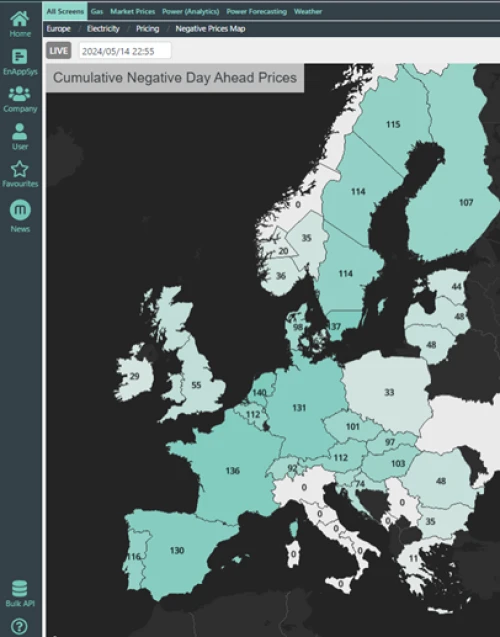

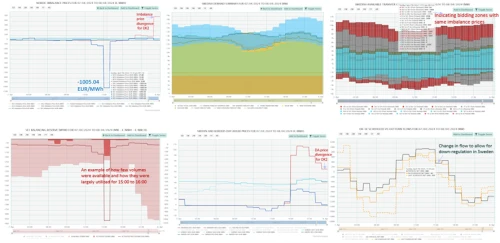

Increasing volatility & negative prices: the Swedish flexibility need

Our Nordic Market Expert, Priyanka Shinde assesses market volatility, price correlation and increasing instances of negative pricing in the country.

We have short and long-term energy prices from multiple energy markets. All prices streamed in real-time.