German solar investment: turning energy markets upside-down?

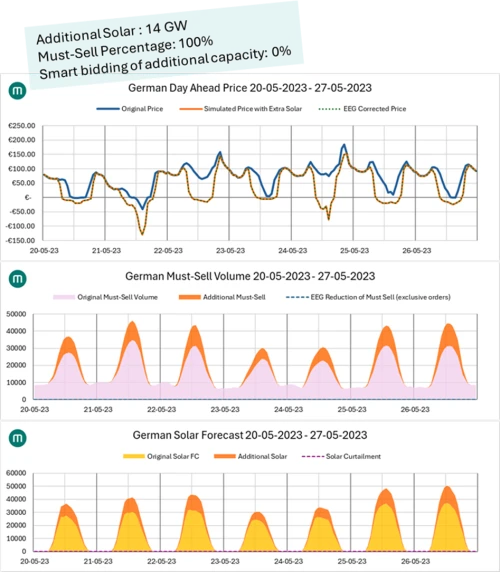

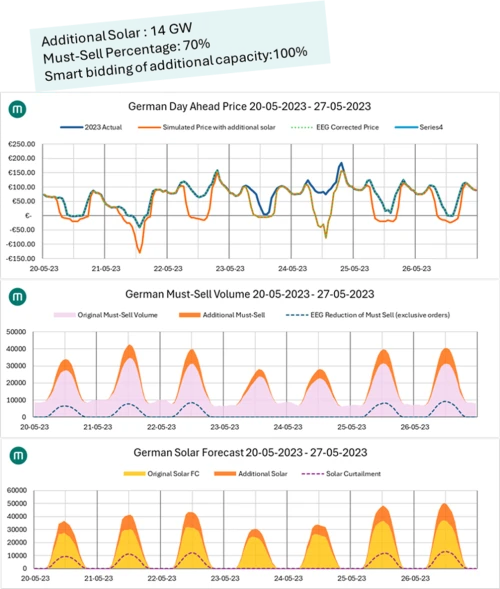

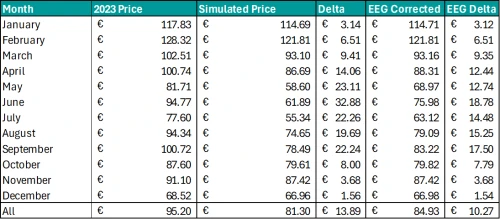

Market Expert Jean-Paul Harreman explains how a new wave of solar power installations could have significant impacts on negative pricing in the German power market.

Looking for data like this?

Find out more about the data and forecasts that make this analysis possible: