France: towards a volatile imbalance price

With French imbalance prices proving changeable in recent times, Territory Manager for France at EnAppSys, Clement Bouilloux, analyses why this is happening and explains the important of high quality forecasts when tracking balancing prices.

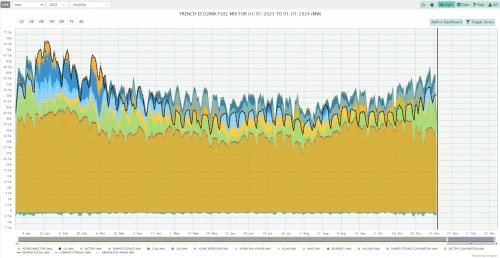

French Fuel Mix 2023:

Data taken from EnAppSys platform

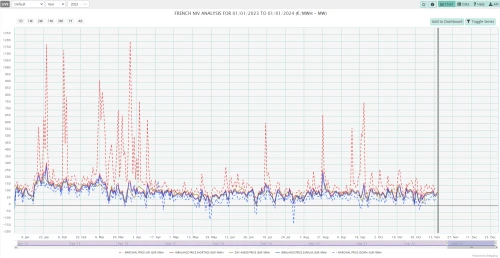

French imbalance prices 2023:

Overview taken from EnAppSys platformManage your market exposure with energy prices from around the world.