Continuous trading takes the Iberian power market by the horns

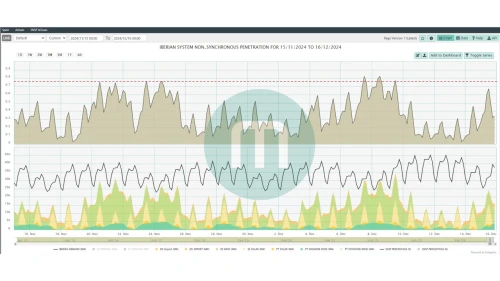

Spain and Portugal are charging towards a renewable-dominated energy system, spurred on by fewer power auctions and more continuous trading. Jean-Paul Harreman, Director at Montel Analytics, explores this transformation in Iberia's power markets.

Get the data you need to trade European power markets in real-time