Austria’s energy mix: how renewables created an independent price area

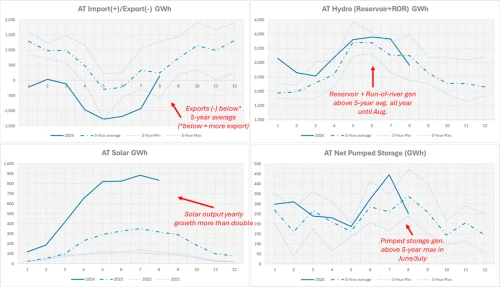

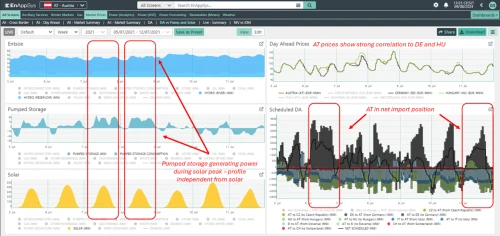

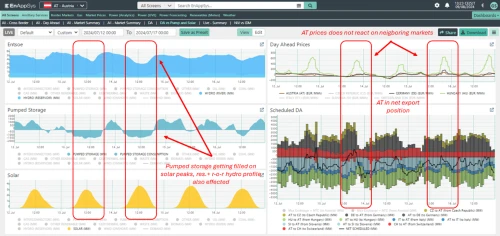

Ahead of Austrian Energy Day 2024, South-Eastern European (SEE) Market Expert, Gábor Szatmári explains how the country has gone from a net importer of power to a (virtually) independent price area within European power markets.

Looking for more information on European hydropower?