Are renewables eating themselves?

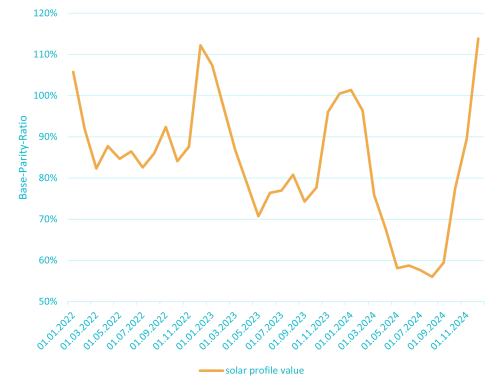

Josephine Steppat, energy analyst at Montel Analytics, examines how developments in recent years such as the energy crisis, price volatility and the renewables buildout have affected PPAs in Europe – and how cannibalisation is increasingly becoming a feature of the market.

Track PPA prices and optimise your power purchasing strategy