Are cross-border PPAs worth the risk?

Floris Greebe, Senior Energy Market Expert at Montel, weighs up the pros and cons of signing multi-country PPAs.

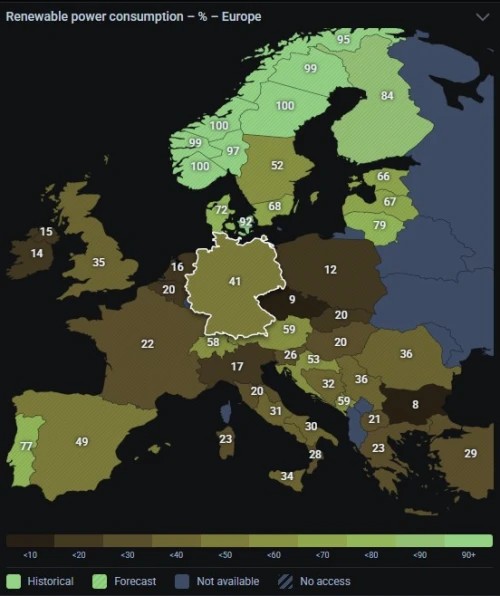

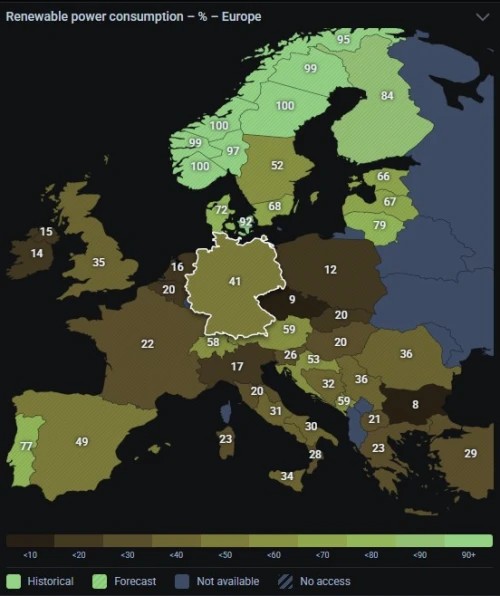

Graphic: Montel Analytics

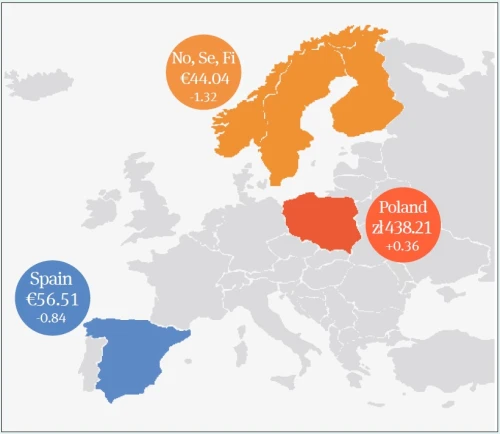

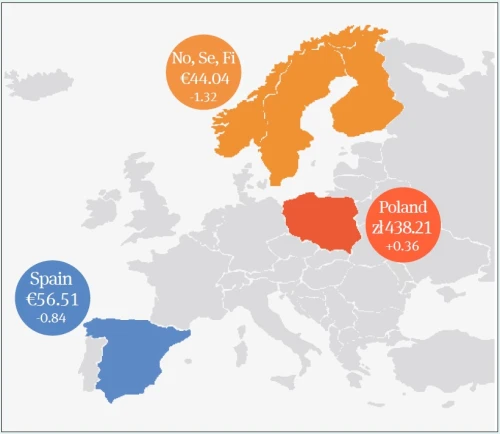

Graphic: QWatt/Montel

Looking for PPA benchmarks?

Floris Greebe, Senior Energy Market Expert at Montel, weighs up the pros and cons of signing multi-country PPAs.

Looking for PPA benchmarks?